All Categories

Featured

Table of Contents

These notes let you invest in small companies, offering them with the capital required to grow. In exchange, you can earn a repaired return on your investment (Private Real Estate Investments for Accredited Investors). If you spend in our note with a 14% annualized yield, you obtain your interest settlements plus the principal at the end of the 2 year term.

Because this kind of financial investment is generally not readily available to the basic public, realty can offer recognized capitalists special possibilities to diversify their portfolios. Actual estate financial investments can also come with drawbacks. Bargains typically require considerable capital and lasting dedications due to high up-front high capital investment like purchase prices, upkeep, tax obligations, and charges.

Some investments are just available to accredited capitalists. Which ones will line up with your goals and take the chance of resistance? Keep reading to figure out. Here are the leading 7 certified investor chances: Exclusive accessibility to personal market financial investments Wide range of alternate financial investments like art, real estate, legal funding, and more Goal-based investing for growth or revenue Minimums beginning with $10,000 Invest in pre-IPO companies through an EquityZen fund.

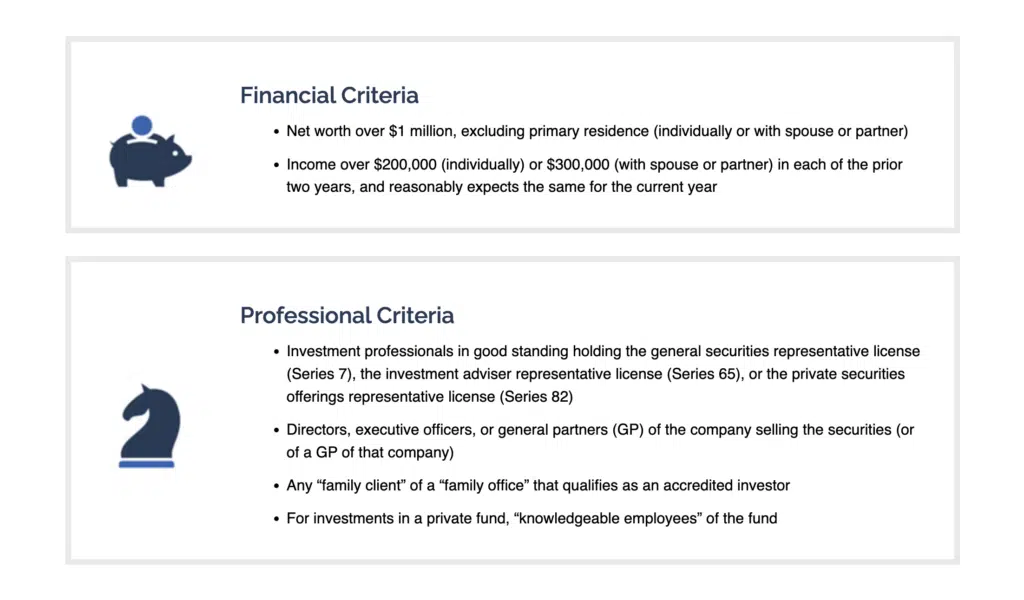

Investments involve threat; Equitybee Stocks, participant FINRA Accredited financiers are the most qualified capitalists in the organization. To qualify, you'll need to meet several demands in earnings, total assets, possession size, administration standing, or expert experience. As a certified capitalist, you have access to extra complex and sophisticated sorts of safety and securities.

What is included in High-return Real Estate Deals For Accredited Investors coverage?

Enjoy access to these alternative investment chances as a recognized financier. Keep reading. Certified financiers usually have a revenue of over $200,000 separately or $300,000 collectively with a spouse in each of the last two years. AssetsPrivate CreditMinimum InvestmentAs low as $500Target Holding PeriodAs short as 1 month Percent is an exclusive debt financial investment platform.

To gain, you simply need to register, spend in a note offering, and wait on its maturation. It's a terrific source of easy income as you do not require to monitor it very closely and it has a short holding duration. Good annual returns range in between 15% and 24% for this asset course.

Potential for high returnsShort holding period Capital in jeopardy if the debtor defaults AssetsContemporary ArtMinimum Investment$15,000 Target Holding Period3-10 Years Masterworks is a platform that securitizes leading artworks for investments. It gets an art work through public auction, then it registers that property as an LLC. Beginning at $15,000, you can purchase this low-risk property class.

Get when it's supplied, and after that you obtain pro-rated gains when Masterworks markets the artwork. Although the target duration is 3-10 years, when the art work gets to the desired value, it can be marketed previously. On its website, the very best appreciation of an art work was a tremendous 788.9%, and it was just held for 29 days.

Yieldstreet has the broadest offering throughout alternate investment platforms, so the quantity you can gain and its holding duration vary. There are products that you can hold for as brief as 3 months and as lengthy as 5 years.

How do I apply for Private Real Estate Investments For Accredited Investors?

It can either be paid to you monthly, quarterly, or once an occasion occurs. One of the drawbacks here is the lower annual return rate compared to specialized systems. It supplies the very same products, some of its competitors outperform it. Its administration charge usually ranges from 1% - 4% each year.

It flips farmland for earnings. Additionally, it obtains rent income from the farmers throughout the holding period. As a capitalist, you can gain in two methods: Receive dividends or money return every December from the rental fee paid by occupant farmers. Gain pro-rated income from the sale of the farmland at the end of the holding period.

Can I apply for Accredited Investor Property Investment Opportunities as an accredited investor?

Nevertheless, if a residential or commercial property gains sufficient worth, it can be marketed previously. Among its offerings was enclosed just 1.4 years with a 15.5% recognized gain. Farmland as a property has traditionally reduced volatility, that makes this a wonderful option for risk-averse capitalists. That being stated, all financial investments still carry a certain degree of threat.

Furthermore, there's a 5% charge upon the sale of the entire property. It spends in various bargains such as multifamily, self-storage, and industrial homes.

Handled fund by CrowdStreet Advisors, which automatically diversifies your investment throughout different properties. When you invest in a CrowdStreet offering, you can obtain both a cash money return and pro-rated gains at the end of the holding duration. The minimum financial investment can differ, however it generally starts at $25,000 for industry offerings and C-REIT.

What is the best way to compare Private Real Estate Deals For Accredited Investors options?

Genuine estate can be commonly reduced danger, yet returns are not assured. In the history of CrowdStreet, more than 10 residential properties have adverse 100% returns.

While you will not get possession below, you can possibly obtain a share of the profit once the startup successfully does a leave event, like an IPO or M&A. Many great business stay exclusive and, for that reason, usually hard to reach to investors. At Equitybee, you can fund the supply choices of workers at Stripe, Reddit, and Starlink.

The minimal investment is $10,000. This platform can possibly provide you huge returns, you can also lose your entire cash if the start-up fails. Because the transfer of the securities is manual, there's a danger that workers will decline to abide by the agreement. In this case, Equitybee will certainly exercise its power of lawyer to educate the issuer of the stock to launch the transfer.

What does Accredited Investor Real Estate Deals entail?

So when it's time to exercise the alternative during an IPO or M&A, they can benefit from the prospective increase of the share cost by having a contract that enables them to buy it at a price cut. Exclusive Real Estate Crowdfunding Platforms for Accredited Investors. Access Hundreds of Startups at Past Valuations Expand Your Portfolio with High Development Startups Buy a Previously Hard To Reach Property Class Based on availability

Alpine Note is a temporary note that gives you reasonably high returns in a brief duration. It can either be 3, 6, or 9 months long and has a set APY of 6% to 7.4%. It additionally provides the Ascent Earnings Fund, which spends in CRE-related senior debt financings. Historically, this earnings fund has actually outshined the Yieldstreet Choice Revenue Fund (formerly called Yieldstreet Prism Fund) and PIMCO Earnings Fund.

Other attributes you can spend in consist of acquiring and holding shares of business areas such as industrial and multifamily homes. Nevertheless, some individuals have actually complained about their absence of openness. Evidently, EquityMultiple does not communicate losses immediately. And also, they no more release the historical efficiency of each fund. Temporary note with high returns Absence of openness Facility costs framework You can qualify as a certified investor making use of two standards: monetary and professional capacities.

Table of Contents

Latest Posts

State Property Tax Sales

Property Tax Default List

Property Tax Delinquent Sale

More

Latest Posts

State Property Tax Sales

Property Tax Default List

Property Tax Delinquent Sale