All Categories

Featured

Table of Contents

The meaning of a certified capitalist (if any type of), and the repercussions of being identified as such, vary in between nations.

It specifies sophisticated capitalists so that they can be dealt with as wholesale (rather than retail) customers., a person with an advanced financier certification is an innovative financier for the function of Chapter 6D, and a wholesale client for the purpose of Phase 7.

A corporation included abroad whose tasks are comparable to those of the companies laid out over (qualified investment). s 5 of the Stocks Act (1978) specifies an advanced capitalist in New Zealand for the objectives of subsection (2CC)(a), an individual is well-off if an independent legal accountant licenses, no greater than 12 months before the offer is made, that the chartered accountant is satisfied on sensible premises that the person (a) has internet possessions of a minimum of $2,000,000; or (b) had a yearly gross earnings of a minimum of $200,000 for each of the last two fiscal years

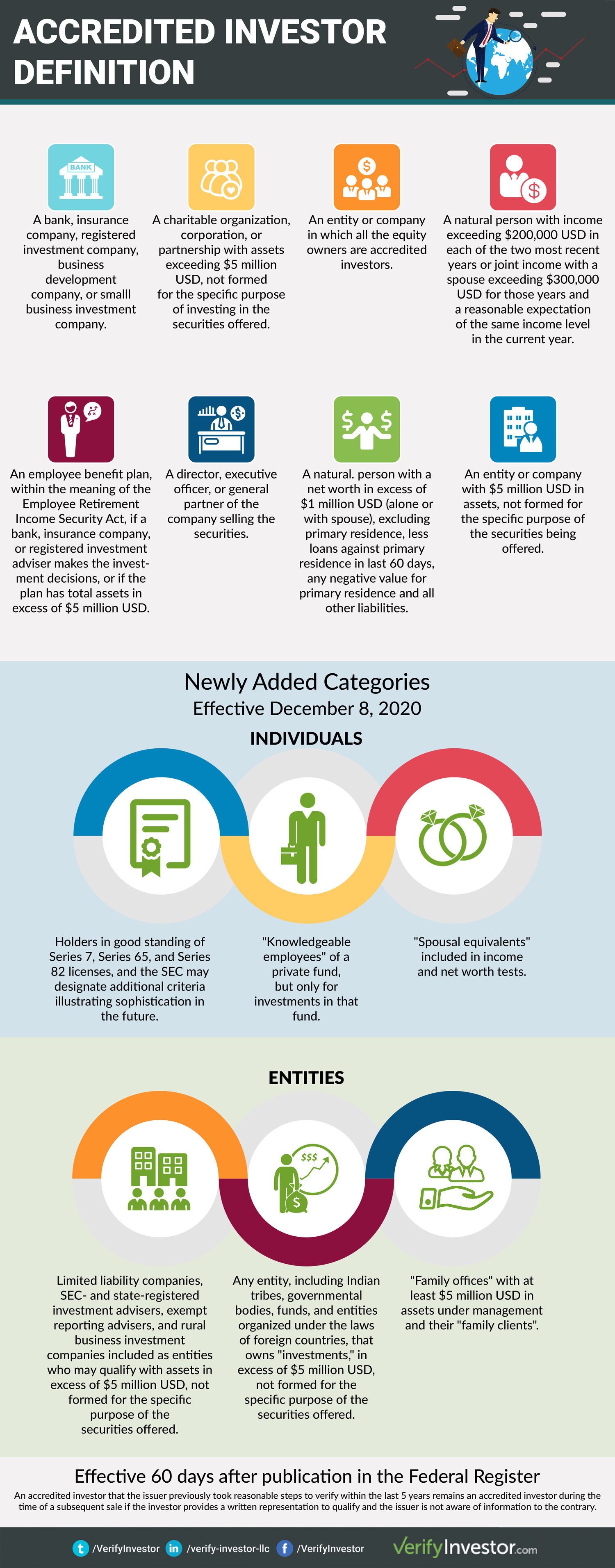

A lot more precisely, the term "certified financier" is defined in Rule 501 of Guideline D of the U.S. Securities and Exchange Payment (SEC) as: a bank, insurer, signed up investment business, company advancement company, or little company investment firm; a worker advantage strategy, within the definition of the Employee Retired Life Earnings Protection Act, if a bank, insurer, or signed up investment consultant makes the financial investment choices, or if the strategy has overall possessions over of $5 million; a philanthropic company, company, or collaboration with possessions surpassing $5 million; a director, executive policeman, or general partner of the company selling the safeties; an organization in which all the equity proprietors are recognized investors; an all-natural individual who has individual internet worth, or joint total assets with the individual's spouse, that goes beyond $1 million at the time of the purchase, or has possessions under administration of $1 million or above, omitting the worth of the person's key home; an all-natural individual with earnings going beyond $200,000 in each of both newest years or joint income with a spouse surpassing $300,000 for those years and an affordable assumption of the exact same income level in the present year a trust with possessions in excess of $5 million, not developed to acquire the safeties provided, whose purchases a sophisticated person makes. "Spousal equivalent" to the accredited financier meaning, so that spousal equivalents may pool their finances for the objective of qualifying as certified financiers. Retrieved 2015-02-28."The New CVM Instructions (Nos.

Sec Accredited Investor Verification

17 C.F.R. sec. BAM Capital."Even More Capitalists Might Obtain Access to Exclusive Markets.

Recognized investors include high-net-worth people, financial institutions, insurer, brokers, and counts on. Approved capitalists are specified by the SEC as certified to invest in complicated or sophisticated types of safety and securities that are not very closely regulated - rule 501 regulation d accredited investor. Specific requirements need to be satisfied, such as having an ordinary yearly income over $200,000 ($300,000 with a partner or cohabitant) or operating in the monetary market

Non listed securities are inherently riskier due to the fact that they lack the regular disclosure needs that come with SEC registration., and numerous bargains involving complicated and higher-risk financial investments and instruments. A business that is looking for to raise a round of financing might choose to straight approach certified investors.

It is not a public company however wishes to introduce a going public (IPO) in the near future. Such a firm might make a decision to provide securities to certified investors directly. This type of share offering is referred to as a personal placement. non accredited investor investments. For recognized financiers, there is a high possibility for threat or incentive.

Alternative Investments For Accredited Investors

The regulations for certified capitalists differ amongst territories. In the U.S, the interpretation of a recognized capitalist is presented by the SEC in Regulation 501 of Law D. To be an accredited investor, an individual should have a yearly revenue exceeding $200,000 ($300,000 for joint income) for the last two years with the assumption of gaining the same or a greater income in the existing year.

This amount can not consist of a main house., executive officers, or directors of a company that is releasing unregistered safeties.

Accredited Investors Leads

Also, if an entity includes equity proprietors that are accredited capitalists, the entity itself is an accredited financier. Nonetheless, a company can not be developed with the single function of purchasing specific protections. A person can certify as a recognized financier by demonstrating adequate education and learning or task experience in the economic industry.

Individuals that want to be recognized investors do not apply to the SEC for the classification. financial investor definition. Instead, it is the obligation of the company offering a private placement to ensure that every one of those approached are recognized financiers. People or celebrations who intend to be accredited capitalists can approach the company of the non listed safety and securities

Sec Angel Investor Requirements

Expect there is a private whose earnings was $150,000 for the last 3 years. They reported a key residence worth of $1 million (with a home mortgage of $200,000), an automobile worth $100,000 (with an exceptional lending of $50,000), a 401(k) account with $500,000, and a cost savings account with $450,000.

Total assets is determined as possessions minus liabilities. This individual's net worth is exactly $1 million. This involves a calculation of their assets (besides their primary home) of $1,050,000 ($100,000 + $500,000 + $450,000) less a cars and truck financing amounting to $50,000. Since they meet the total assets need, they certify to be a certified financier.

There are a couple of less common qualifications, such as managing a count on with even more than $5 million in properties. Under government securities legislations, only those that are recognized financiers may take part in particular securities offerings. These may include shares in exclusive placements, structured items, and exclusive equity or bush funds, to name a few.

Table of Contents

Latest Posts

State Property Tax Sales

Property Tax Default List

Property Tax Delinquent Sale

More

Latest Posts

State Property Tax Sales

Property Tax Default List

Property Tax Delinquent Sale