All Categories

Featured

Table of Contents

As recognized capitalists, people or entities might engage in private financial investments that are not registered with the SEC. These financiers are assumed to have the financial sophistication and experience required to examine and purchase risky investment chances hard to reach to non-accredited retail capitalists. Right here are a few to think about. In April 2023, Congressman Mike Flooding presented H.R.

For now, financiers should comply with the term's existing definition. There is no formal process or federal certification to end up being an accredited investor, a person may self-certify as a recognized financier under existing laws if they made even more than $200,000 (or $300,000 with a partner) in each of the past 2 years and anticipate the same for the present year.

Individuals with an active Series 7, 65, or 82 certificate are also considered to be accredited financiers. Entities such as firms, collaborations, and counts on can additionally accomplish certified financier standing if their investments are valued at over $5 million.

What should I know before investing in Real Estate For Accredited Investors?

Private Equity (PE) funds have revealed amazing growth in recent years, apparently undeterred by macroeconomic difficulties. PE firms swimming pool capital from accredited and institutional capitalists to get regulating passions in fully grown personal firms.

In addition to resources, angel financiers bring their expert networks, support, and proficiency to the startups they back, with the expectation of venture capital-like returns if the service takes off. According to the Center for Venture Research, the average angel financial investment amount in 2022 was roughly $350,000, with capitalists obtaining an average equity risk of over 9%.

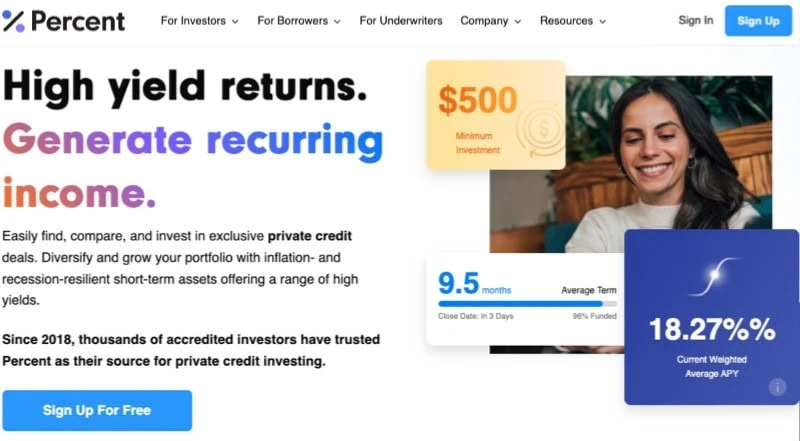

That stated, the advent of online private credit score platforms and particular niche enrollers has made the possession class accessible to individual recognized investors. Today, investors with as low as $500 to invest can make use of asset-based personal credit rating chances, which offer IRRs of up to 12%. Regardless of the increase of ecommerce, physical supermarket still account for over 80% of grocery sales in the USA, making themand especially the genuine estate they run out oflucrative financial investments for certified capitalists.

In comparison, unanchored strip centers and neighborhood centers, the following 2 most heavily transacted sorts of realty, recorded $2.6 billion and $1.7 billion in purchases, specifically, over the exact same duration. What are grocery store-anchored? Suburban strip malls, outlet malls, and various other retail facilities that include a significant supermarket as the location's main tenant generally fall under this category, although malls with enclosed sidewalks do not.

Approved capitalists can spend in these areas by partnering with actual estate private equity (REPE) funds. Minimum financial investments normally start at $50,000, while total (levered) returns range from 12% to 18%.

What should I know before investing in Private Real Estate Deals For Accredited Investors?

Over the last years, art has made average annual returns of 14%, trouncing the S&P 500's 10.15%. The market for art is additionally expanding. In 2022, the global art market grew by 3% to $67.8 billion. By the end of the decade, this figure is anticipated to approach $100 billion.

Financiers can currently have diversified exclusive art funds or purchase art on a fractional basis. These options feature investment minimums of $10,000 and use web annualized returns of over 12%. Endeavor resources (VC) remains to be among the fastest-growing property courses worldwide. Today, VC funds flaunt more than $2 trillion in AUM and have released even more than $1 trillion into venture-backed startups because 2018including $29.8 billion in Q3 2023 alone.

If you've seen ads for genuine estate financial investments, or any kind of other kind of investing, you might have seen the term "certified" prior to. Some investment chances will just be for "approved" financiers which are 506(c) offerings. This leads some individuals to think that they can not spend in genuine estate when they can (after all, "approved" sounds like something you earn or use for).

How can Real Estate Syndication For Accredited Investors diversify my portfolio?

However, what occurs if you intend to purchase a small company? Maybe there's a diner down the road that you intend to invest in to obtain a 25% equity risk. That diner, certainly, won't register with the SEC! That's where approved investing enters into play. That restaurant might obtain investments from certified financiers but not nonaccredited ones.

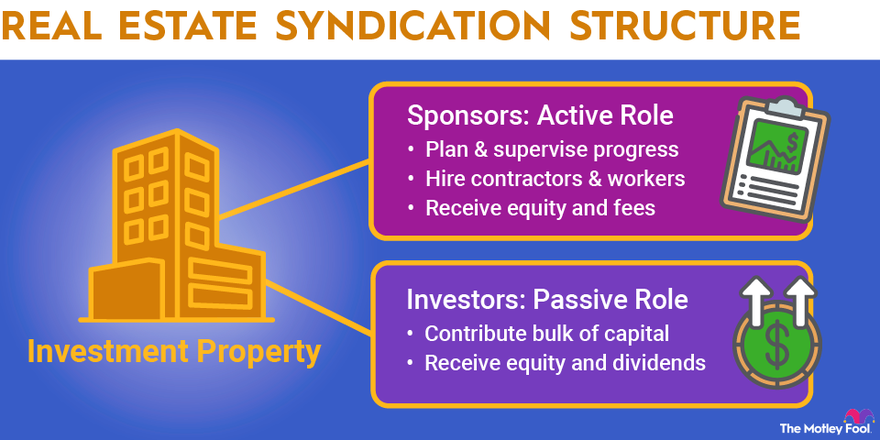

With that background in mind, as you could think of, when somebody obtains financiers in a brand-new home structure, they have to typically be recognized. Numerous of them are open to nonaccredited capitalists.

Just how is that a nonaccredited realty investing alternative? The answer hinges on a subtlety of the regulation. A nonaccredited genuine estate investment possibility is a 506(b) bargain named after the section of the law that authorizes it. Syndications under this regulation can not publicly market their securities, so it is needed that the sponsors (individuals putting the syndication with each other) have a preexisting partnership with the capitalists in the offer.

Maybe one of the most simple and intuitive investment chance for a person that doesn't have accreditation is acquiring and holding rental building. Certainly, you don't need any type of special classification to buy the condo or home down the street and lease it out to occupants. Certainly, that's an advantage due to the fact that purchasing and holding leasings is a wonderful method to develop your net worth! Normally, residential property values appreciate, and you can create a consistent monthly revenue stream! The only downside is that you're on the hook for anything that goes wrong! And, you need to manage all your tenants' questions also at 3am or work with a property supervisor to do so (which can become costly, depending on the location). Getting and holding rental properties is probably the most uncomplicated of all the unaccredited genuine estate spending choices! You have actually unquestionably seen or come across all the turning shows on television.

Part of the factor these programs are all over is that flipping does function mostly. You can discover homes cheaply, remodel them, and market them for a tidy profit if you recognize where to look. If you go behind the scenes on these shows, you'll typically recognize that these financiers do a lot of the work on their very own.

The idea behind this technique is to keep doing the complying with action in sequence: Acquire a single-family home or apartment that needs some job. Rehab it to make it both rentable and enhance the home's worth. Lease it out. Refinance the home to take out as much of your preliminary funding as possible.

What should I know before investing in Passive Real Estate Income For Accredited Investors?

What if you don't have that saved up yet however still desire to spend in actual estate? These companies generally buy and run shopping centers, shopping centers, home structures, and other large real estate financial investments.

Table of Contents

Latest Posts

State Property Tax Sales

Property Tax Default List

Property Tax Delinquent Sale

More

Latest Posts

State Property Tax Sales

Property Tax Default List

Property Tax Delinquent Sale