All Categories

Featured

Play the waiting game until the residential or commercial property has actually been seized by the county and sold and the tax sale.

Pursuing excess proceeds supplies some pros and cons as a company. Take into consideration these prior to you add this method to your genuine estate investing repertoire.

There is the possibility that you will certainly gain nothing in the end. You might shed not just your money (which ideally won't be really much), but you'll likewise lose your time also (which, in my mind, is worth a lot a lot more). Waiting to accumulate on tax sale overages calls for a whole lot of sitting, waiting, and wishing for results that typically have a 50/50 opportunity (typically) of panning out positively.

Accumulating excess profits isn't something you can do in all 50 states. If you've currently obtained a residential or commercial property that you intend to "chance" on with this method, you would certainly better wish it's not in the incorrect part of the country. I'll be honestI have not spent a great deal of time meddling this area of investing due to the fact that I can not deal with the mind-numbingly sluggish speed and the complete absence of control over the procedure.

In addition, many states have laws affecting bids that surpass the opening bid. Repayments over the area's standard are recognized as tax sale overages and can be successful financial investments. The information on overages can develop troubles if you aren't conscious of them.

In this short article we tell you exactly how to get listings of tax obligation overages and generate income on these properties. Tax obligation sale overages, likewise understood as excess funds or exceptional proposals, are the amounts quote over the starting rate at a tax obligation public auction. The term refers to the dollars the financier spends when bidding process over the opening bid.

The $40,000 increase over the original proposal is the tax obligation sale excess. Declaring tax sale excess means acquiring the excess money paid during an auction.

That said, tax sale overage insurance claims have shared characteristics across many states. Throughout this duration, previous owners and home mortgage owners can contact the county and get the excess.

If the period runs out before any interested parties claim the tax sale overage, the region or state generally soaks up the funds. As soon as the cash goes to the government, the opportunity of declaring it vanishes. Previous owners are on a strict timeline to claim overages on their buildings. While excess typically don't equate to greater profits, financiers can make the most of them in numerous ways.

Tax Owed Homes For Sale

, you'll make passion on your whole bid. While this aspect doesn't mean you can claim the overage, it does assist minimize your expenses when you bid high.

Remember, it could not be legal in your state, suggesting you're limited to gathering rate of interest on the excess. As mentioned above, an investor can discover methods to make money from tax sale excess. Due to the fact that interest revenue can relate to your whole proposal and previous owners can claim excess, you can take advantage of your knowledge and devices in these circumstances to make the most of returns.

An essential aspect to keep in mind with tax sale overages is that in the majority of states, you just need to pay the county 20% of your complete bid up front., have laws that go past this policy, so once again, study your state legislations.

Instead, you just require 20% of the bid. If the property does not redeem at the end of the redemption duration, you'll require the remaining 80% to obtain the tax obligation act. Since you pay 20% of your bid, you can make passion on an excess without paying the full cost.

Once more, if it's lawful in your state and area, you can function with them to help them recover overage funds for an extra fee. You can collect passion on an overage bid and bill a cost to improve the overage claim procedure for the previous owner.

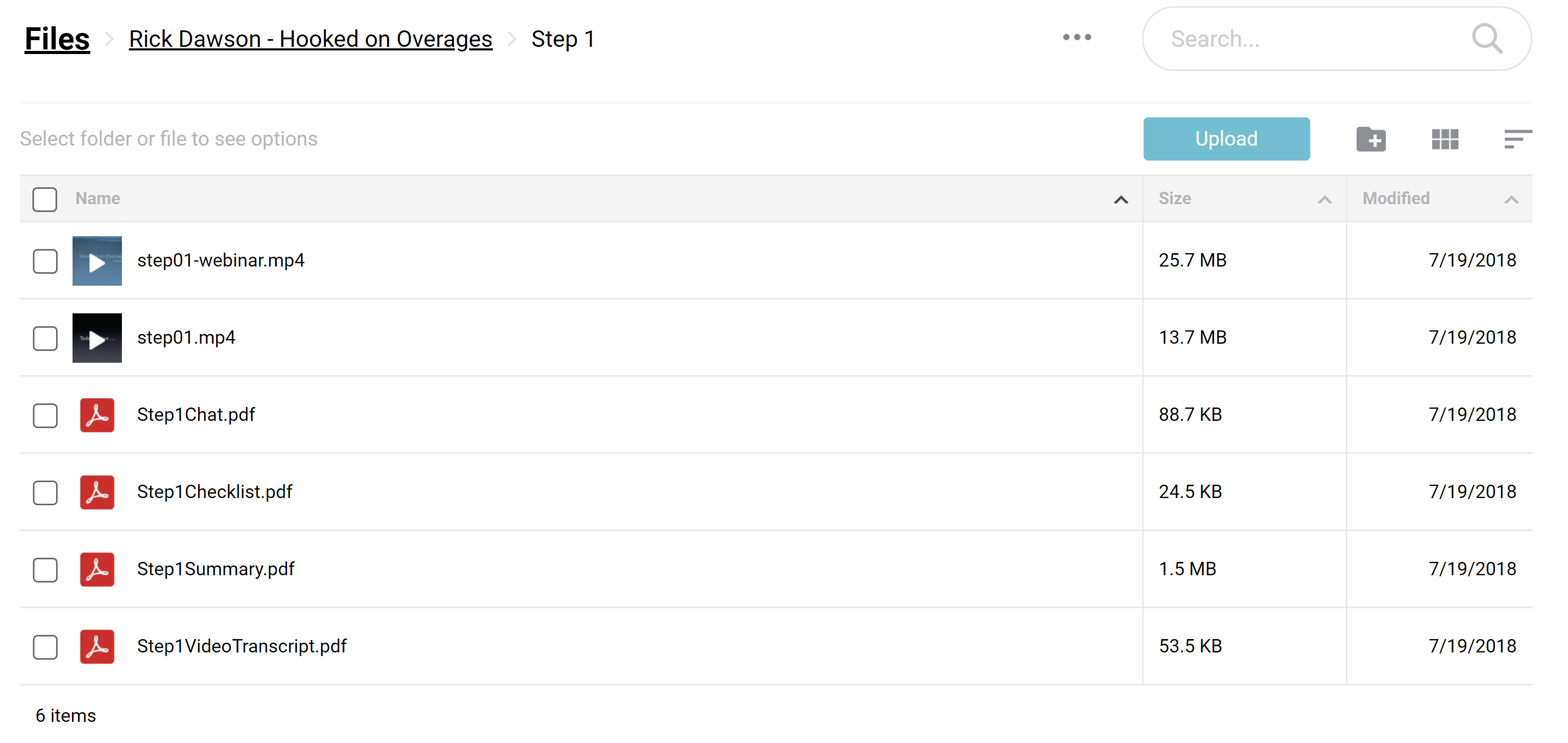

Overage collection agencies can filter by state, county, home type, minimal overage quantity, and optimum overage amount. Once the information has been filteringed system the collectors can make a decision if they desire to include the skip mapped data plan to their leads, and afterwards pay for only the confirmed leads that were discovered.

Houses For Sale For Back Taxes

To get started with this video game transforming product, you can discover more here. The most effective method to obtain tax obligation sale excess leads Concentrating on tax obligation sale excess rather than traditional tax lien and tax deed investing requires a certain technique. In enhancement, much like any other investment technique, it uses unique pros and cons.

Tax obligation sale excess can develop the basis of your financial investment design since they supply a low-cost method to earn cash (tax deed states list). You do not have to bid on properties at auction to invest in tax sale overages.

Instead, your research, which might entail avoid mapping, would certainly set you back a relatively little charge.

Your sources and method will certainly identify the ideal environment for tax overage investing. That stated, one technique to take is accumulating passion on high costs.

Additionally, overages put on even more than tax obligation acts. So, any type of public auction or foreclosure involving excess funds is an investment chance. On the other hand, the main drawback is that you could not be awarded for your effort. You can spend hours investigating the previous proprietor of a home with excess funds and contact them just to discover that they aren't interested in seeking the money.

Latest Posts

State Property Tax Sales

Property Tax Default List

Property Tax Delinquent Sale